Search

Top Stories

Explore the latest updated news!

Stay Connected

Find us on socials

Made by ThemeRuby using the Foxiz theme. Powered by WordPress

Budget Hacks by Bianca Market: Easy Tricks to Save Money

Imagine this: you check your bank account at the end of the month, and once again, most of your paycheck…

Business

Empowering success through innovation and strategy

Fashion

Where style meets elegance and expression

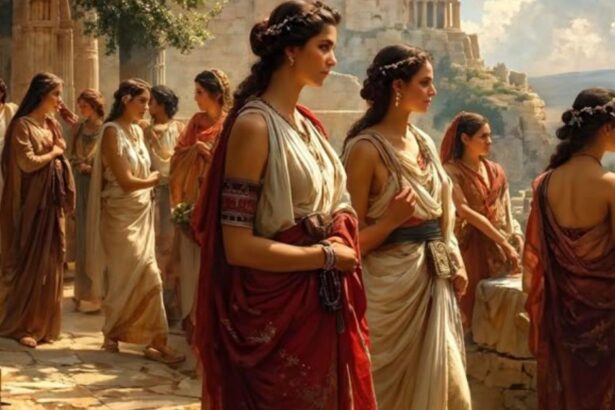

Technology

Revolutionizing the future with innovation and progress

Sports

Fueling passion, teamwork, and competitive spirit

Latest News

Explore the Blog